IR35 and Off-Payroll working

The Government has confirmed that it intends to reform the off-payroll working rules (commonly known as IR35) from 6 April 2020. This was then delayed until 6th April 2021. This change will impact recruitment agencies who provide off-payroll workers via intermediaries, such as personal service companies (PSCs), to medium and large businesses in the private sector and to the public sector.

Under the detailed proposals, medium and large businesses in the private sector will have a number of obligations.

They will need to determine whether or not the IR35 rules apply to an engagement and provide a status determination statement (SDS) to the worker and any third party, for example a recruitment agency, setting out the reasons for reaching that determination.

The recruitment agency will then be required to pass on the determination to the next party in the labour supply chain, for example a second agency. Failure to pass on the determination will result in the tax and NIC liabilities resting with the party that fails to pass on the determination.

The functionality must be turned on in General Settings

To enable your Agency to manage it’s IR35 responsibilities there are new fields on the Company and Candidate record.

Company Record:

If the Company is outside of IR35 and you are not required to hold a Status Determination Statement from the Company then you can select the ‘Small Private Sector Outside IR35’ option. Any large Private sector.

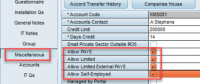

On the Miscellaneous view of the Company record you can select which payment methods the Company will accept:

Candidate Record:

From April 2020 you, as an Agency, will be required to hold a Status of Determination Statement for each candidate you place.

There is a new view for Company SDS, above the Placement view. Enter the Client Contact who has determined the status, how the Candidate is to be paid and the Reason for the decision. Copies of the SDS Documents should be kept on the Documents view. We advocate adding a new Document Type to be used.

Making Placements/Booking Shifts:

When creating a placement or booking a shift for a Temp (who is NOT PAYE or External PAYE) there will be a popup SDS form to record the Status. If an SDS has not been received Cancel, and remind the Client that they need to send one within 31 days of the placement start date. Completing a timesheet will also check for the existence of an SDS. If one does not exist the SDS form will popup. In addition one can be manually added on the Person SDS view.

Validations will need to be added if a placement or a Timesheet is to be BLOCKED because different sectors have different requirements. Contact IQX to arrange.